Summerset is a stock I like and hold, despite concerning prospects for the property industry and economy this year. It’s recently dropped in price a little, so I thought I’d do a quick and dirty price check to see if it’s worth buying.

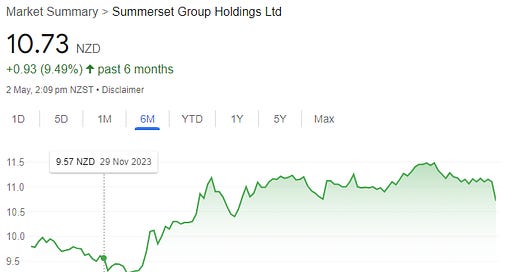

The above graph shows the share price in the last 6 months, including the price on the 29th of Dec, which was the last time I recommended it as a buy at $9.511 (congratulations to everyone following me into that one - you’ve made over 30% annualized return2) and it’s current price drop from ~$11.15 to ~$10.73 at the time of writing.

Before I do the “price check”, let’s look at the sales stats which where published since my last analysis. I’ve graphed these for your convenience.

It’s too little data to look at seasonal trends (which you definitely should if you’re considering buying - please share your findings in the comments), with which to ascertain whether the 2023 Q4 peak was the start of a false run or normal, but generally my feeling is that the company is coping with the poor property market. However, I am concerned that things will get worse, which gives me hesitancy.

Looking at the numbers, Summerset has a market cap of $2,528m3 at the time of writing at a share price of $10.73. The last report for the Year Ended 31 December 2023 gave an Underlying profit for FY23 of NZ$190.3 million, up 11.0% on FY224. Those two numbers give rise to a PE of 13.3 (let’s call it 13 because there’ll be money in the bank that I’ve neglected to deduct from the market cap). Using the same logic as my last price check, that gives 7.69% of value in the current share price. This number is above my risk free rate, which is 6.75%5.

Even though a return of 7.69% is above the rate of inflation (4.7%6), one percent return over my risk free rate isn’t much, so there’s not much risk premium in there given the current risks to the economy and property market (which I didn’t feel was present during my last analysis). For this reason, I’m not rushing out to buy Summerset shares at this price, but I’ll acknowledge that Summerset stock is currently about fair value. I think if a person was to buy at this price, it’s a bit of a gamble about whether that would pay off by the end of this year, but I feel that it would certainly pay off on a longer term than a year. While the price may well increase from here in the months to come, I’m going to hold out for a better priced stock later in the year (or as one comes up, which may include a further fall in the price of Summerset).

Based on the current share price of $10.73, minus the purchase price of $9.51, divided by the purchase price, multiplied by 100 to get the percentage return, then divided by 5 months, multiplied by 12 months to work out the annualized return.

Which is the rate I’d borrow against: https://www.westpac.co.nz/home-loans-mortgages/interest-rates/