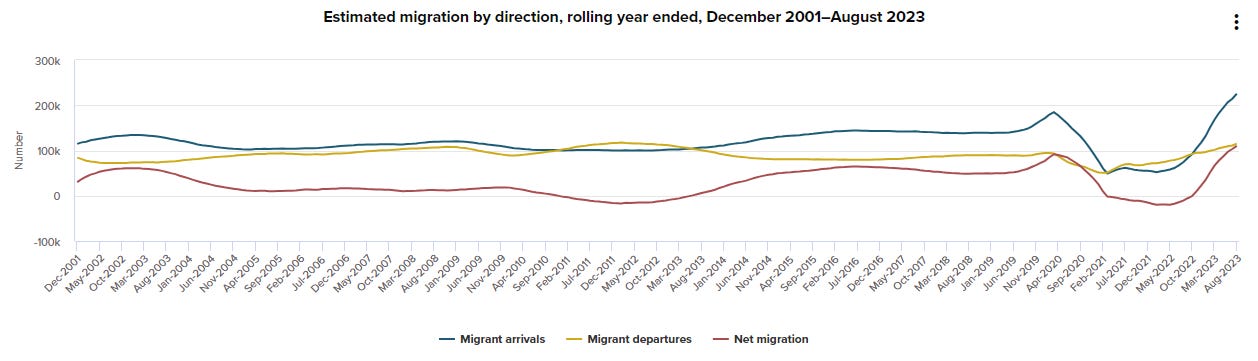

It feels like we’re around the bottom of the housing market and prices aren’t likely to drop further. We have signals that inflation is coming under control over the next few years, so my feeling is that the OCR isn’t going to need to increase by more than a couple of percentage points in that time period, if at all. We also have an increase in migration that will put demand pressure on housing. We also have a broad increasing of wages. These factors all suggest that we could be approaching the start of another property boom in the coming year or two, or at least that prices will stop falling.

The prospect that house prices could level off or increase makes me think that retirement property could become more profitable as they could become able to take bigger profits from sales in an upward market. Also, while the choice to move into a retirement home is largely one born of necessity, a retirees own home value increasing does make the prospect more attractive and could result in increased spending (such as upgrades or moving into other types of retirement property earlier, resulting in increased spending).

This made me wonder if there’s still growth in demand for the retirement sector, so I took at look at NZ’s population growth stats by age and discovered this trend:

I think this answers the titular question: yes, there is growth left in the NZ retirement sector for a number of years. Is now the right time to buy into the retirement sector? Well, that’s another question. It’s possible that the above effects could take a few years to work through and there’s the potential state of the share market in the next year to consider and naturally the state of any individual retirement investment. Personally, my feeling is that it wouldn’t be a bad long term investment but there might be a better time to buy in.